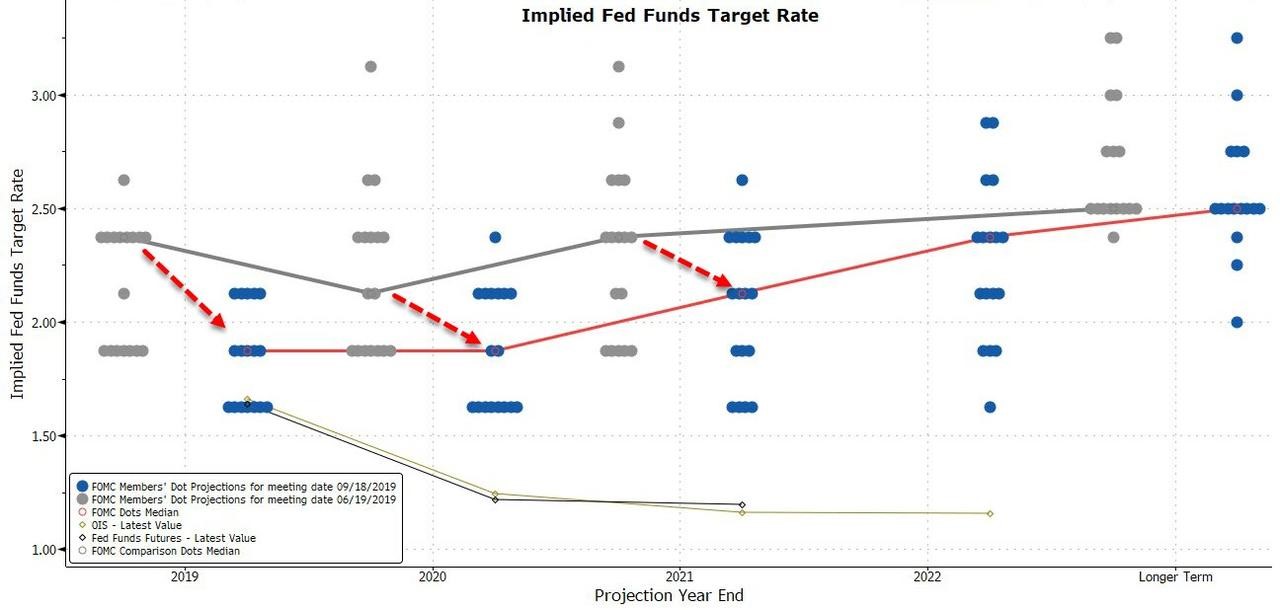

Following the September 18th Federal Reserve Open Market Committee (FOMC) meeting, the FOMC announced a 25 bp cut in the fed funds rate target range which now stands at 1.75%-2.00%. The FOMC Chairman cited again that this was done only as insurance against ongoing risks. However, as a group, they also indicated that they did not expect any more rate cuts in 2019 or 2020. In fact, their overall expectation for the fed funds rate target range over the next several years is for a flat to slightly increasing fed funds rate (see Exhibit 1). This is consistent with another recent speech from the FOMC Chairman where he indicated that the FOMC’s growth outlook was for continued positive growth and the unemployment rate remaining low. However, the individual FOMC voting members were divided on this rate cut and split on whether or not another rate cut would occur this year. At the time of this writing, markets are fully expecting one more 25 bp cut in 2019. The U.S. Treasury yield curve remains slightly inverted, but not as inverted as previous weeks where short-term yields were higher, and longer-term yields were lower. As a reminder, inverted yield curves have historically been associated with slowing economic growth and recessionary environments at some point following their occurrence. If that were to be the case this time as well, the expectation would be for a lower fed funds rate target over the next several quarters and potentially years.

Exhibit 1

Given the above, how should you interpret the seemingly mixed interest rate messages? For starters, let’s look at some economic points. First off, there are at least pockets of weakness in our economy in sectors such as manufacturing and trucking. Trucking and freight delivery are often seen as an early indicator of economic activity. Some have argued that the trend in corporate profits is pointing towards economic weakness, and some employers will need to reduce employee numbers. There have also been pockets of weakness globally which leads some to believe it is only a matter of time before it spills over into the U.S. Lastly we have the length of this moderate expansion itself as being one of the longest in history, and one would expect that at some point we would experience at least a moderate amount of weakness. However, U.S. GDP growth expectations remain positive by most major economists including the Federal Reserve, the unemployment rate remains low, and some recent economic measures have surprised positively to the upside. But how much more can the consumer (which drives the majority of U.S. GDP) spend and take on increasing amounts of debt?

Following these economic points does not make the picture much clearer. Given these interest rate and economic growth uncertainties, how should you proceed when managing your credit union and setting rates in terms of expectations as we move into 2020? The term data-dependent gets used by FOMC communications quite often, but the data does not seem to provide much clarity. At this time, we are in a wait and see or time will tell mode. It is likely a vital period to be monitoring incoming economic data more closely and keeping an eye on the U.S. Treasury yield curve. Keep in mind that even if the FOMC fed funds rate target projections come to fruition, there is not a lot of upside on the horizon. Then compare this to the possibility that interest rates have started back downward and potentially could head back to previous lows and even lower. A large portion of global debt is at negative yields, and funds seeking higher returns in U.S. Treasuries also put downward pressure on those yields. Rates increasing or decreasing quickly seems unlikely, so strategizing rate setting and the impact to earnings as market rates change, should be slow and more easily managed. At Mark H. Smith, Inc., we always advocate a prudent practice of considering the possibility of either rising or falling interest rates as we do not have a crystal ball. However, just based on the U.S. Treasury yield curve, length of this economic expansion, global yield environment, and mostly the FOMC’s actual actions versus their forward communication, it is likely beneficial to have a sharper focus on the overall continuation of the recent lower interest rate trend that may have begun.