There has been talk and speculation that the Fed may unwind some of the rate increases they have made over the last two years. One of the biggest factors contributing to interest rate risk is the possibility that in a rising rate environment, funding costs will increase quicker and higher than interest income, causing net interest margins to decrease and earnings to be negatively impacted. Regulators have emphasized potential exposures in a rising rate environment and have constantly warned that credit unions will face income challenges when rates increase. The fear is that when interest rates increase, the credit unions' ability to remain profitable and viable will be at risk.

Most of the interest rate risk modeling we have done, for the instantaneous and parallel 3% uprate shock, forecasts improvement in net interest margins during a three-year timeframe. Occasionally, there is a decrease (interest rate risk) in the net interest margin in the first year. Once the credit union has increased dividend rates necessary to retain funding, net interest margins typically improve and outpace the flat rate net interest income forecasts. Some regulators may express that positive results in an uprate scenario cannot be realistic. When a large percentage of the credit union’s funding is in regular shares and share drafts, the ability to control interest rate risk and improve net interest margin is highly likely. Regular shares and share drafts have much lower rate sensitivities than other deposits and can be managed to control funding costs while the assets reprice.

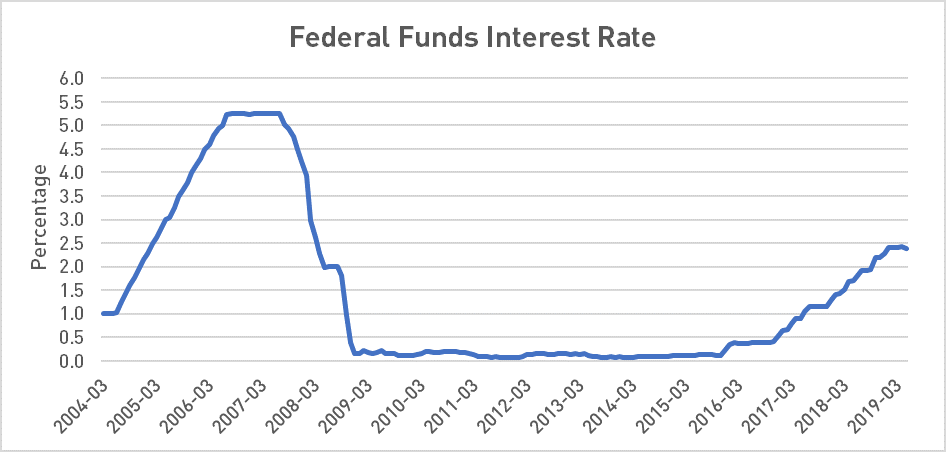

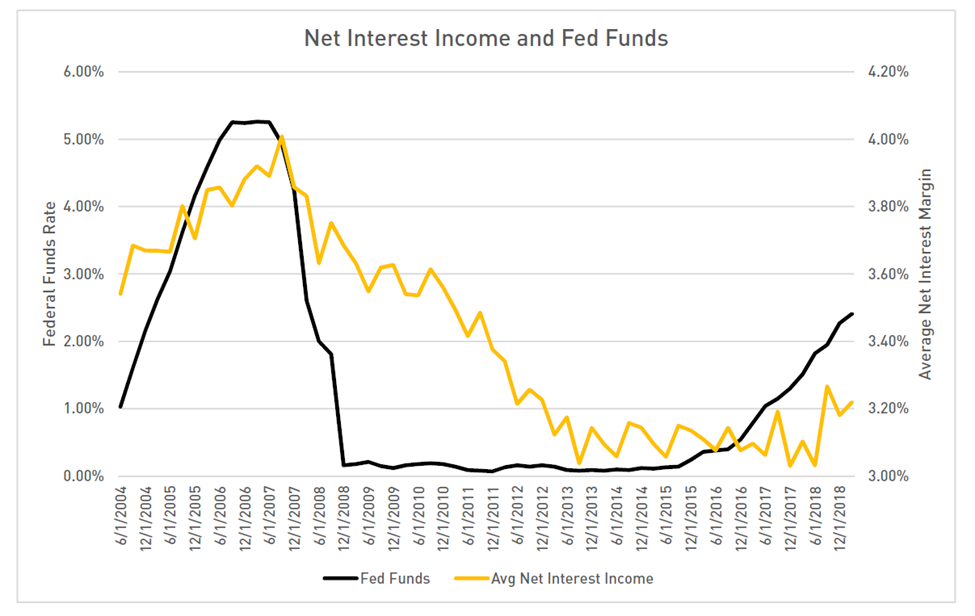

Based on Federal Reserve data, federal fund rates bottomed out at .07% in 2014 and remained low for the next two years. From 2017 to now, rates have steadily increased anywhere from 11 to 25 basis points each quarter. As of May 31st, 2019, the rate was 2.39% and was three basis points from the highest point in over ten years. From December 2016 to now the steady rate increases total 185 basis points. Many of us have been lulled along as rates have increased because the overall impact to net interest margins and earnings have been subtle, but good. This increase is almost two-thirds of the customary 300 bps rate shock. While the rate increase has been gradual, not instantaneous or parallel and the yield curve has flattened, the increase should not be considered trivial. For two and one-half years rates have increased steadily, but there has been very little movement in deposit rates and cost of funds.

FRB_H15 2019 03

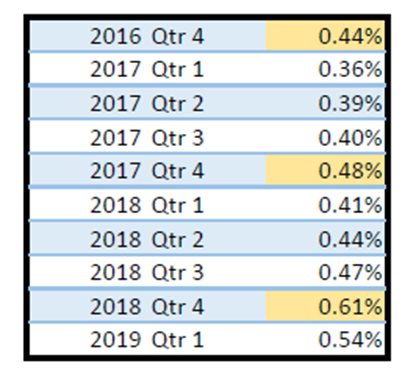

After the financial crisis, there was a significant inflow of deposits into federally insured financial institutions as individuals looked for safe places to hold their money. Most of the deposits that came in seem to have stayed in the system. Some deposits may have left the security of a bank or credit union for more lucrative pastures, but total deposits at credit unions continued to increase. Loan growth has been good over the last few years, and some financial institutions experienced liquidity pressures and raised their deposit rates or ran CD specials to entice new deposits to fund more loan growth. Credit unions that did not need to buy deposits were able to keep dividends very close to the historical lows and retain deposits, and net interest margins improved when asset yields increased. The following chart shows how little cost of funds have changed since quarter 4 of 2016. It is worth noticing in the 4th quarter of each year that cost of funds increased and then settled lower in the first quarter of the year. This increase can be tied to special dividends given at year end to share profits and give back to members. The act of giving back to the members demonstrates a big difference between credit unions and banks.

Total Credit Union

Weighted Average Cost of Funds

The chart demonstrates that cost of funds increased, but it was minimal and gradual. Therefore, net interest margins improved. One of the biggest factors for the improvement in net interest margins is primarily due to the ability to control funding costs. When net interest margins improve as interest rates increase, interest rate risk is relatively non-existent.

Now with the possibility that market rates may decline, managers and boards should prepare for the likelihood that the improvements in net interest margins that have been enjoyed the last few years may be coming to an end. As interest rates tumbled in 2008 and 2009, many credit union boards were slow to reduce dividend rates and earnings were impacted. If rates do decline, even though the funding increases have been minimal, credit unions should consider reversing any dividend increases as soon as possible. If asset yields unwind and deposit rates are reduced, with limited ability to reduce deposit rates, net interest margins will compress. For many years, the down rate shock scenarios of the interest rate risk analysis were dismissed as improbable. Now that the possibility is growing that interest rates may decrease, it is important to review and discuss the down rate scenarios. Strategies and the potential impact to the net interest margin should be discussed with your board and ALCO.