By Mark H. Smith, CEO, Mark H. Smith, Inc.

NCUA has proposed major revisions to its original Risk Based Capital (RBC) Rule published early in 2014. The revisions include major changes in the number of credit unions impacted, the implementation period, and the risk weights proposed for various classes of assets. Also, the Rule lowers the level of RBC necessary to be considered well-capitalized under the Rule.

These revisions did not come easy. The original Rule proposed 12 months ago was presented by NCUA Chair Debbie Matz as a take-it-or-leave-it proposition. Only after unprecedented industry response and congressional pressure did NCUA relent and agree to a revised proposal and a new comment period. Recently appointed board member J. Mark McWatters appears to have tipped the scale when he expressed serious concerns about revisions to the proposed Rule and the lack of a new comment period.

In this article, we briefly summarize some of the major changes to the proposed Rule and their estimated impact on the credit union system.

- Fewer credit unions are impacted by the revised Proposal. Only credit unions whose total assets exceed $100 million will be required to comply with the Rule if adopted. Compliance will be required by January 2019, which is a much longer phase-in period than the original Rule.

- A new comment period will be allowed under the Proposal. The period is 90 days from the date of publication in the Federal Register.

- Changes in the numerator (capital) are minimal. The allowance for loan and lease losses may now be included under the Proposal without limit. Changes are also proposed for the treatment of some outstanding goodwill.

- Changes to the denominator are comprehensive.

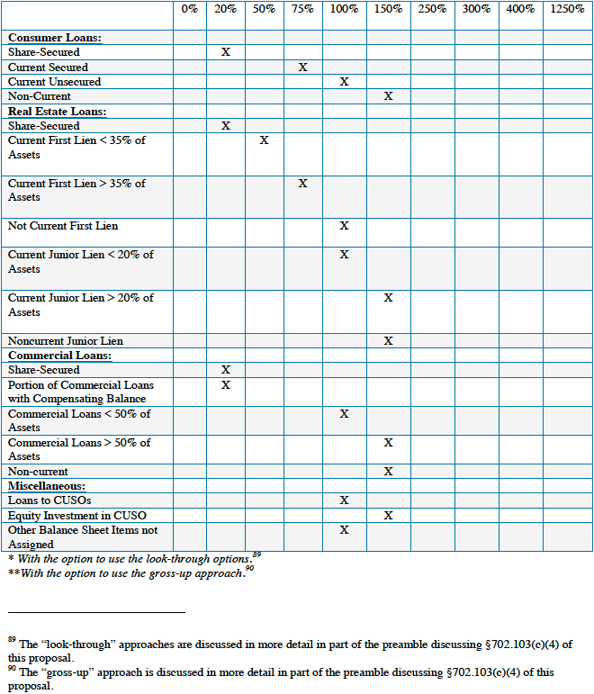

- Consumer loans remain more or less the same. The risk weights for share-secures loans is lowered; however, the proposed risk weight for unsecured consumer loans is increased. One major change is that past-due loans are allowed at the standard risk weight to the point of 90 days delinquent, rather than 60 days in the Original Proposal.

- Residential real estate loans are proposed for a major change. A single tier break for the category is proposed. First-lien residential real estate loans require additional capital when they reach 35% of assets. Junior liens break at 20% of assets. This is a significant and more favorable proposal. A major change is that 1- to 4-family non-owner occupied loans will now be classed a residential real estate rather than member business loans in the previous proposed Rule.

- Commercial loans are redefined under a new criteria in the proposed regulation. The new definition of commercial loans is beyond the scope of this article and will be treated in the next issue of CU ALM Report. However, the change in the designation of the 1- to 4-family non-owner occupied excludes them from this category and adds them to the residential real estate. Additionally, commercial loans subject to a contractual compensating balance are treated much more favorably under the new Proposed Rule.

- The individual minimum capital requirement (IMCR) has been removed. This revision, which would have allowed NCUA to require a higher minimum level of capital from individual credit unions, was one of the most sensitive of the issues raised in comment letters.

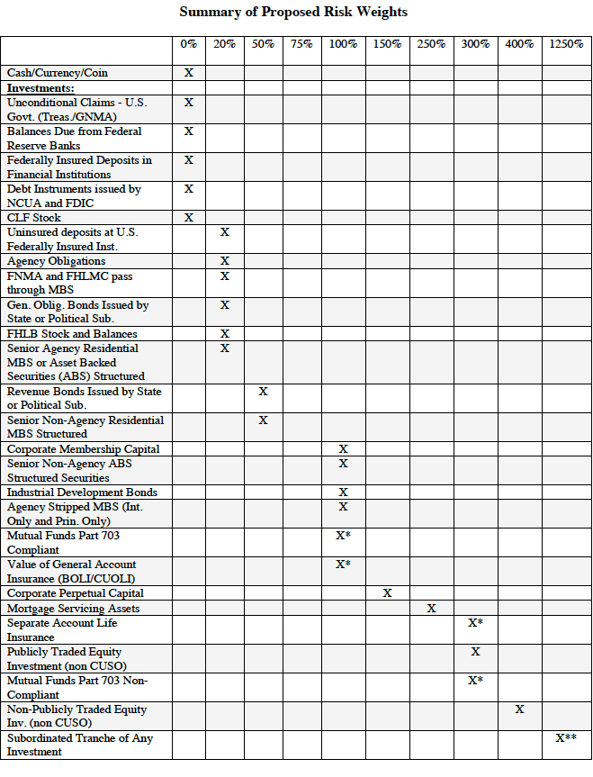

- Interest rate risk (IRR) has been effectively removed from the Proposal. The weighted average life component is no longer applied to investments. Risk weights are applied to investments based on the perceived investment type’s credit risk.

- A complete listing of proposed risk weights can be found at the end of this article.

The proposed Rule is a presented in its entirety—all 450 pages—on the Agency’s website www.ncua.gov. The Agency has also provided an estimator which allows individual credit unions to estimate the impact of the proposed Rule on their balance sheets.

So what should you be doing now?

- We encourage you to familiarize yourself with the Proposed Rule and exercise your comment privilege with NCUA. Without the unprecedented number of comments received on its Original Proposed Rule, most of us feel that this revised Proposal would never have come about.

- Estimate the impact that the proposal would have if enacted and if necessary explore alternatives available to you.

We feel the probability of adoption is high. Credit unions should clearly understand the proposal and its impact on them. Mark H. Smith, Incorporated will present a webinar to explain the proposed Rule more fully on Thursday, January 29, 2015. To register for the free webinar go to our website or click on the following link.