As we move into 2021, the following topics might be worth discussing and considering with your management team.

Earnings

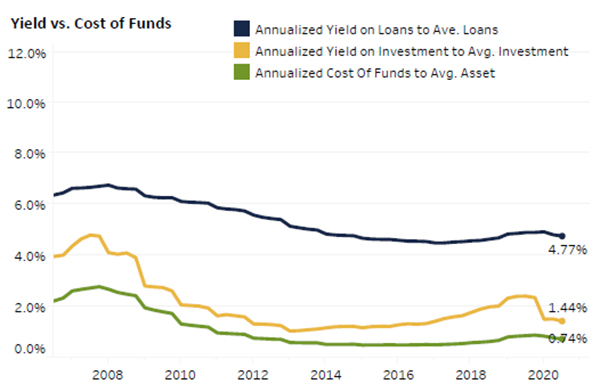

During the first half of 2020, net interest margins came under substantial pressure as market interest rates were shocked dramatically downward. Net interest margins are expected to remain under downward pressure throughout 2021 as investment portfolios continue to reprice lower and share growth continues.

One of the easiest and quickest responses to declining interest income is to address the cost of funds. Many credit unions still have room to decrease their cost of funds, as shown in the September 2020 ending period graph below.

Source: NCUA

Source: NCUA

Delinquency

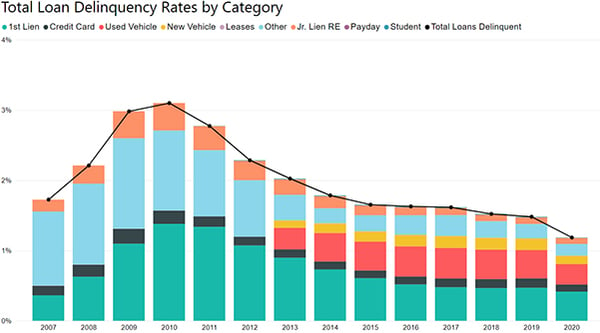

Based on the September 2020 call report data, loan delinquencies and net charge-offs remained low and were below September 2019 delinquencies. Loan forbearance and other assistance programs in place through the entirety of 2020 may have helped delinquencies. Also, certain sectors of the economy are not as impacted as others. The unemployment rate is expected to continue drifting lower in 2021. However, as the assistance programs are lifted, delinquencies and charge-offs are expected to increase as unemployment remains substantially above the years leading up to the pandemic.

Source: MHSI Online Peer Analysis Module through September 2020

Credit Union Philosophy

Serving the underserved has always been a hallmark of credit unions, and now more than ever, there is an opportunity to do this for many credit union members. As these times have been challenging, credit unions can continue to evaluate and prioritize how to best serve members in the coming year, especially those under financial stress. Exploring how to provide service to those that are underbanked might be an opportunity. One option may include evaluating risk-based lending policies and programs, especially given the robust liquidity on most credit union balance sheets. New and alternative avenues to bolster income should continue to be explored.

Digital and Technology

As the pandemic shifts and prolongs, credit unions should evaluate if their electronic delivery channels meet members and potential members’ needs. Moving to or improving digital delivery channels should be accelerated and prioritized. Digital delivery should include evaluating loan origination and servicing channels to maximize new loan volumes. Online and remote financial services will continue to grow and may be the preferred way members access and manage their financial activities.

Balance Sheet Growth

Before the pandemic, many experts anticipated credit union loan growth to taper off but remain positive. After the first quarter of 2021, loan production became unpredictable, however, by the end of the third quarter, annualized loan growth was 6.34%. Real estate lending, driven by the abruptly lower interest rate environment, helped with the growth. Experts anticipate loan growth to be around 6.0% to 6.5% over the next 12 months as the economy recovers.

The first few months of 2021 may see strong share growth as the second round of government assistance and stimulus takes hold, and households remain reluctant to spend until signs of COVID easing and warmer weather occur. Share growth last year increased at an annualized rate of over 18% and is expected to be approximately 8.0% to 10.0% in the coming year. If double-digit growth continues, earnings sufficient enough to sustain capital will be critical. If economic conditions improve and overall consumer activity increases, loan growth and increasing long-term interest rates could counter some of the anticipated income pressures. Fortunately, the credit union industry is very well capitalized and able to ride out the adverse conditions and absorb some more growth, even if earnings are reduced.