Mark H. Smith Staff

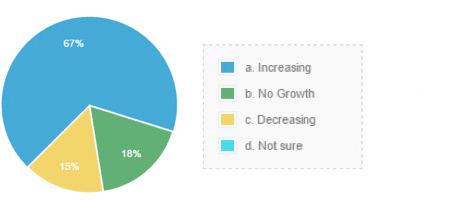

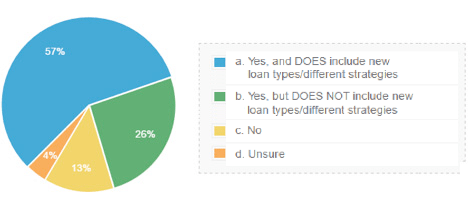

There has been quite a bit of media attention paid to loan growth in the last year. We surveyed credit unions, both clients and non-clients, to better understand their lending trends and environment. The results are interesting and indicate 67% of the responding credit unions are experiencing loan growth and in many cases it is a result of a solid strategy combined with new product offerings. The credit unions responding are also exploring alternative loan strategies they may not currently offer. Some of these strategies include indirect loans, sub-prime loans, longer-term consumer loans, expanded mortgage lending, reward visa programs, expanding unsecured and short-term loans, storage buildings, recreational vehicles and business lending.

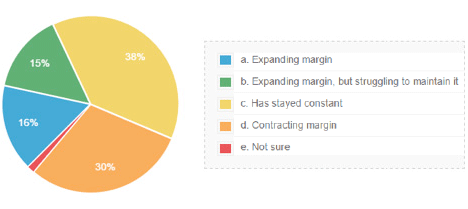

While loan portfolios have grown at many of the credit unions, the net interest margins have expanded in only 16% of respondents while another 15% indicate some net interest margin expansion but it has been a struggle to maintain. 38% said their margin has stayed constant. As rates remain low, margins may continue to compress requiring continued efforts to promote lending, develop new loan products, and find profitable loan products other than the highly competitive A grade auto loans to sustain credit union earnings.

- LOAN GROWTH: How would you describe the growth of your loan portfolio in the last 12 months?

- LOAN STRATEGY: Would you say you have a solid strategy for growing your loan portfolio, and does it include new loan types or different strategies than you’ve used before?

- MARGIN GROWTH: How would you describe your net interest margin in the last 12 months?

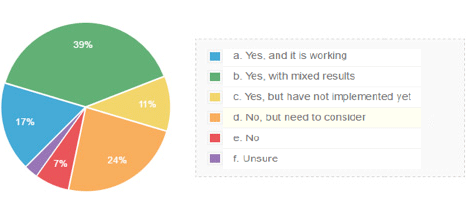

- MARGIN STRATEGY: Would you say you have a solid strategy for maintaining or growing net interest margin?

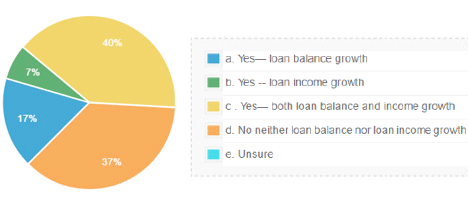

- MEETING EXPECTATIONS: Did your 2015 loan balance and loan income grow to meet the credit union’s expectations?

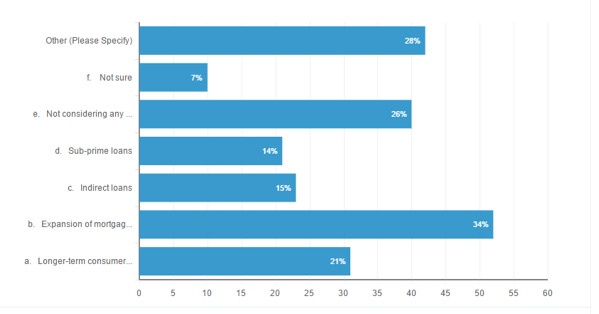

- Are you considering alternative loan strategies that you are currently not utilizing? (multiple answers accepted)

Specific detail on "Other" category listed below:

- Targeting specific existing members for their loans at other financial institutions

- Working with enterprise

- Loan participations

- Rewards Visa credit card program

- Increased unsecured lending

- Risk based pricing implementation & purchasing consumer loan participations

- Risk based pricing

- Balloon note financing

- Purchasing Loan participations

- Loan specials

- Direct auto refi

- Longer-term consumer, expanded mortgage, and indirect loans

- Indirect, subprime and consumer loans

- First-time car buyers & credit re-builder loans

- Business Lending

- Student loans

- Student loan consolidation

- Expansion of shorter term loans

- Retail financing paper

- Participated member business loans

- Storage buildings/Heating cooling units

- 5/5 adjustable real estate loans with 2.00% increase cap per adjustment

- New member loan rate promotions and full membership summer rate promotions on consumer loans

- Expansion of credit card portfolio

- HELOCs Only