By Cynthia R. Walker, CEO, Mark H. Smith, Inc.

The adage “A picture is worth a thousand words” appeared in newspapers in the early 1900s and refers to the notion that a complex idea can often be presented more easily with an image. A Napoleon Bonaparte quote is translated to say, “A good sketch is better than a long speech.”

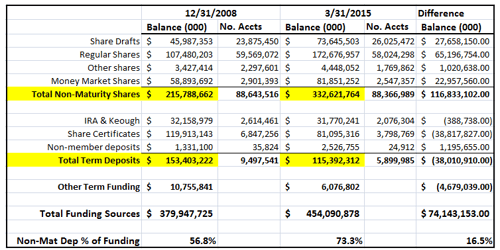

Since the financial crisis in 2008, the credit union industry has experienced a significant increase in total deposits, along with a transition from time deposits to non-maturity deposits. Aggregate call report data from SNL Financial reveals that total credit union funding in 2008 was $693.4 billion dollars with 54% of the deposits in non-maturity shares. From 2008 through the first quarter of 2015, credit union funding grew by $339.4 billion and non-maturity shares grew to 70% of the total funding.

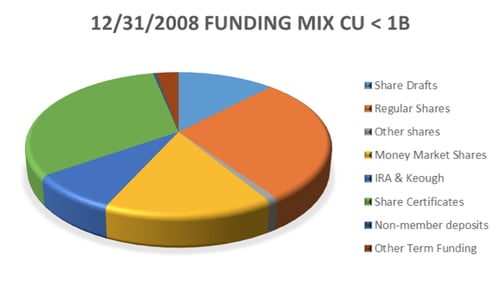

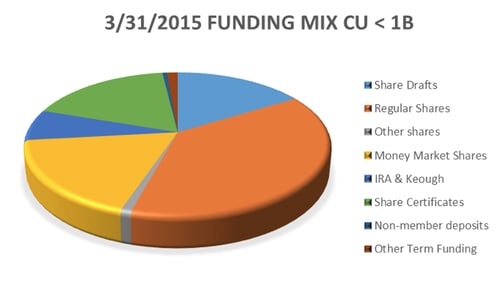

The picture is slightly different for credit unions with total assets less than 1 billion. The total funding sources were $380.0 billion with 56.8% in non-maturity shares at the end of 2008. As of March 2015 the funding grew by $74.1 billion to $454.1 billion and a shift from term deposits to 73.3% now in non-maturity deposits.

The credit union funding mix has changed quite dramatically over these 7 years. This change should be considered when evaluating interest rate risk. Given the concentration in non-maturity deposits, I recommend management and the ALCO review current NMD assumptions closely. This review might include a study of past NMD behavior, growth trends and changes in funding mix within your credit union, along with possible changes in behavior and funding mix looking to the future. It is very important to document these discussions in meeting minutes. Non-maturity shares assumptions used when modeling interest rate risk should reflect not only what has happened in the past but be as accurate as possible in assuming what might happen in the future so the risk profile results can be relied upon. Some questions to ask with regard to deposits and funding mix are:

- Do we think the additional shares that came into the credit union after 2008 are going to stay at the credit union?

- What deposits might leave? Are we considering the implications to liquidity? (Liquidity Risk)

- If the money stays in the form of non-maturity shares, can we increase rates very slowly as we have in the past or will we have to pay a higher rate on some of it to keep it? (Interest Rate Risk)

- If it stays and CD rates start to increase, but share rates do not increase as much, will the money move back into certificates? (Interest Rate Risk)

- Do we have a segmentation strategy in place so we do not have to raise rates on all deposits, but only on the rate-sensitive money?

A couple of things we know for sure; rates have been very low for a long time and the funding mix for credit unions has changed. We also know we are in a situation where past behavior may not be a good predictor of the future of these deposits. There are several schools of thought on this topic.

Some think the deposits moved to the credit union for safety and liquidity, with very little regard to interest rate. The people who had solid savings during the crisis survived, those who did not struggled.

Others think the delta between regular share rates and money market rates, versus certificate rates is not enough for the member to lock in a rate, especially if they think rates are going to rise.

Most likely it is a combination of both scenarios.

I think it would be very worthwhile and prudent to consider the variables and periodically run multiple scenarios through your model to evaluate possible outcomes. Then discuss the outcomes with the management team and make adjustment or changes to your IRR management plan if necessary. Also consider evaluating scenarios that are plausible and even likely, along with the traditional stress scenarios. This additional testing will help provide a strong understanding of interest rate risk at your credit union.

Comparative data showing the move from time deposits to non-maturity shares: