Mark H. Smith, Inc. recently conducted a survey on CECL and Comprehensive Loan Analytics. This was a follow-up survey to the CECL survey we conducted earlier in the year (see previous CECL survey results here). This survey was designed to assess Mark H. Smith, Inc. credit union client needs not only from a CECL perspective, but also to explore their needs for more comprehensive and in-depth loan analytics. Here are the results of our survey:

Level of Current Loan Analytics and Future Plans

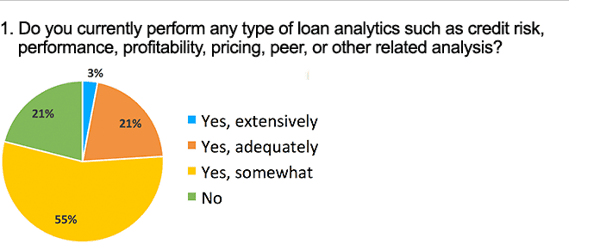

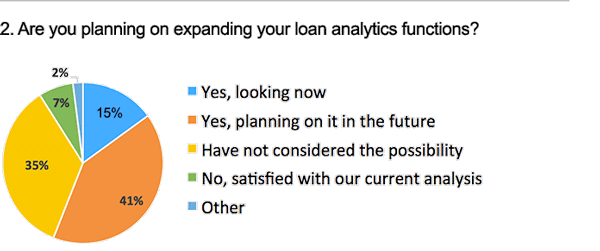

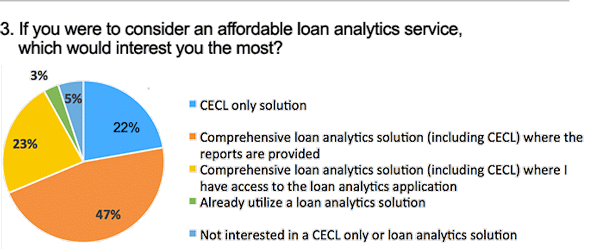

Based on the survey, most credit unions currently performed some level of loan analytics, but the majority believed it to be a minimal amount. However, most were looking to expand their loan analytics function. This was the case for credit unions of all asset sizes. A large majority would be interested in an affordable loan analytics service.

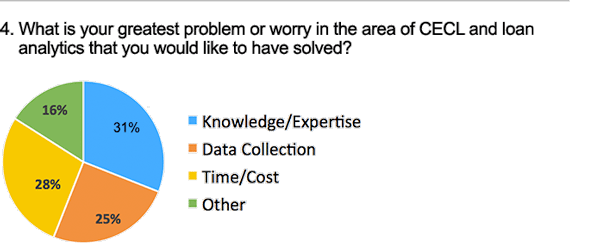

Biggest Concerns with CECL and Loan Analytics

The biggest concerns with CECL and loan analytics were in finding the knowledge/expertise, time/cost, and data collection methods. The good news is that you no longer need to have a big budget to afford comprehensive and in-depth loan analytics. Technology improvements have made it so more credit unions have access to extensive credit risk and performance loan analytics without the high cost or in-house sophistication.

CECL and Loan Analytic Solutions

We understand these concerns and are listening! At Mark H. Smith, Inc., we will be offering a CECL-only solution and a comprehensive loan and deposit analytics solution.

Survey Questions and Graphs

Below are the questions that were asked in the survey and a graphical representation of the response to each of them.

As always, we are dedicated to providing our credit union clients with high-quality services and extensive client support at an affordable price. Our goal is to add value to your credit union.Your success is our success.