In February 2020, I attended the CUNA GAC conference. It was a treat to attend a conference with intelligent, friendly, down to earth people working in the credit union industry. One take away from the conference was the continued importance of credit unions as a financial resource for many Americans. The motto of, “People helping people”, or “Not for profit, not for charity, but for service” emphasizes the unique purpose of the credit union industry. I am familiar with a credit union that recently changed its mission statement as it went through an extensive reevaluation of its culture. The new mission statement is, “We help when no one else will”.

Listening to the speakers, I was again reminded that credit unions are in a position to provide financial services and help many of its members that may not be best served by the for-profit banking sector. The last FDIC household survey conducted in 2017, showed that more than one in four households (26.9%) are either un-banked or under-banked. This means they are conducting some or all of their financial transactions outside of the mainstream banking system. Credit unions can be a shorter and easier step to becoming fully banked. One way to tap into this under-served segment is with the low-income designation and developing processes and products to serve the under-served. Some of the solutions involve technology such as mobile banking and bill pay. Others may include credit counseling along with small-dollar loans for school supplies or unusual loans such as loans to cover funeral expenses. There are still opportunities in the market place to develop and offer financial services to the under-banked.

Credit unions have been successful when their products and services do not compete head-to-head with the larger banks. They should constantly be on the lookout for the unique needs of their members and continually create solutions that fit those needs. Areas of opportunity may be more small-dollar loans and real estate lending. Real estate loans have potential interest rate risk that should be evaluated but they usually have higher yields than investments. The risk-reward trade offs come into play with this decision. In my experience, many credit unions have balance sheets with very little interest rate risk and are well within their interest rate risk policy limits. Long-term loans or investments may present options for increasing interest income. Recently, numerous mortgage companies have tightened their lending standards to protect themselves because of the pandemic. This tightening may be an opportunity for a credit union to get to know its members better and to help in a way that is congruent with the CU philosophy.

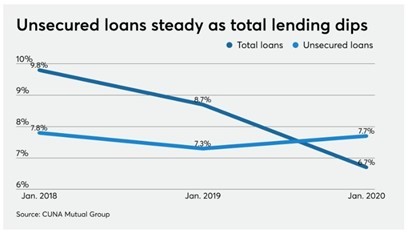

Historically, credit unions have offered a variety of unsecured loan products and have been able to differentiate themselves from banks. According to CUNA Mutual Group’s Credit Union Trends Report for March, the data showed a 6.7% year-over-year total loan growth, down from 8.7% as of January 2019. Unsecured loans have stayed relatively steady with year-over-year growth at 7.7%. As overall loan growth declines, the unsecured loan or small-dollar loans may help the diminishing loan-to-asset ratios. Banks and other financial companies may also see this as an opportunity. Therefore, understanding and meeting the current needs of members may eliminate their exploring outside solutions.

The conference occurred before the Coronavirus pandemic hit the US. The country has changed significantly over the last 2 months, and the economic impact is still unfolding. Progressive, nimble, and attentive credit unions may look at this as a prime time to help members. If and when another challenge happens, those that were helped will remember who assisted them. Stronger relationships and bonds are developed during times like this.

The conference occurred before the Coronavirus pandemic hit the US. The country has changed significantly over the last 2 months, and the economic impact is still unfolding. Progressive, nimble, and attentive credit unions may look at this as a prime time to help members. If and when another challenge happens, those that were helped will remember who assisted them. Stronger relationships and bonds are developed during times like this.

There have been many stories in the news of people going above and beyond to helps others in need. The unusual Easter bunny visits, the waives and smiles through windows, the sharing of a travel trailer, and the offerings to shop for the elderly are only a few examples. The efforts to connect with and help another person, even in a time when social distancing and quarantining have become commonplace, are inspiring. The credit union industry's purpose and mission are parallel with the actions of caring and helping that we are witnessing during this crisis. I feel that credit unions are essential and play an important role in offering quality and affordable financial services to their communities. Now is the time for credit unions to show how they are different from banks. Let's put our words into action and help members navigate and survive this unusual event in a way that is consistent with the mission of “People Helping People”.