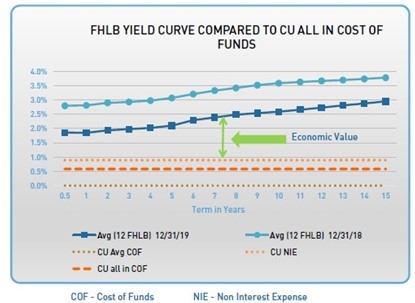

As interest rates increased from 2016 through 2018 so did concerns pertaining to interest rate risk in the up-rate scenarios. Many credit unions saw an increase in the net economic value (NEV) of capital when estimating potential rates up interest rate risk. In the up-rate scenarios, most of the improvement in economic value of capital was a result of the increased benefit received from member shares. In the up-rate scenarios, the increases in the economic value of non-maturity deposits exceeded the decrease in the economic value of assets. In the up-rate scenarios, it is expected that asset values will decline because the yield of the assets will be below-market rates. The increase in the economic value of non-maturity shares in the up-rate scenarios comes from the growing gap between rates paid on shares, including non-interest expenses, and market or wholesale funding rates. The market rates commonly used for non-maturity deposits are the wholesale funding rates or the cost to borrow from a Federal Home Loan Bank or a corporate credit union. One can look at the gap between the all-in cost of funds for deposits and the wholesale funding rates as the economic value of non-maturity shares. (See graph below)

As that gap increases, so does the economic value of non-maturity shares. Rates paid on non-maturity shares generally increase much less than market funding rates in a rising rate environment due to lower rate sensitivity of the deposits than market or wholesale funding rates.

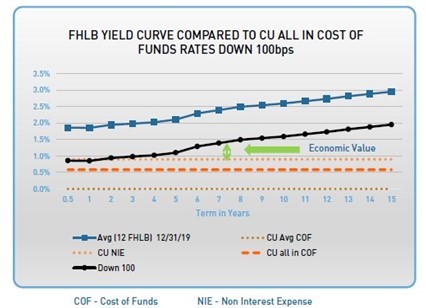

In the current environment, we have seen both short- and long-term market and wholesale funding rates decrease substantially and at a relatively fast pace. Given the fast pace of the rate decreases, it is almost equivalent to an instantaneous and parallel downward interest rate shock in interest rate risk modeling terms. As one would expect, in the down rate scenario, the interest rate gap between market and wholesale funding rates and rates paid on member non-maturity shares has now decreased substantially. As such, the economic value of non-maturity shares will reflect a decline the down interest rate scenario. At the same time the value of the assets increase will increase. We have observed that for many credit unions, the decrease in the economic value of deposits outweighs the increase in the economic value of assets. The result is a decrease in the economic value of capital.

As the market and wholesale funding rates get closer to rates paid on member non-maturity shares, the economic value of member non-maturity shares approaches the book value. When factoring in member deposit account servicing costs or non-interest expense, conceptually, the economic value of non-maturity shares could go below the book value if the market and wholesale funding rates go below the all in cost of funds. In our opinion, this is not a cause for concern in the current environment, particularly given other concerns such as net interest margin pressures, credit risk, and liquidity risk to name a few. The down rate NEV scenario would be relevant only if a credit union was being liquidated or merged and an economic valuation of non-maturity shares became relevant. However, at a minimum, the down rate scenarios provide an evaluation of rates paid on non-maturity shares relative to market and wholesale funding rates. A periodic review of IRR modeling of non-maturity shares; the rate sensitivities (including lagging effects), average life, and servicing cost assumptions is always recommended. Alternatively, consider giving additional attention to the non-maturity shares at par (or book value) NEV analysis to isolate the impact on capital of changing interest rates applied to the loan and investment portfolios. The economic value of these asset categories is relevant to the current rate environment and marketplace.